🙏 Support Newgale's Campsite Crash Victims: Help Dan's family after the recent crash. Our Ordo Payments donation page ensures your support goes directly to them. Make a difference today.

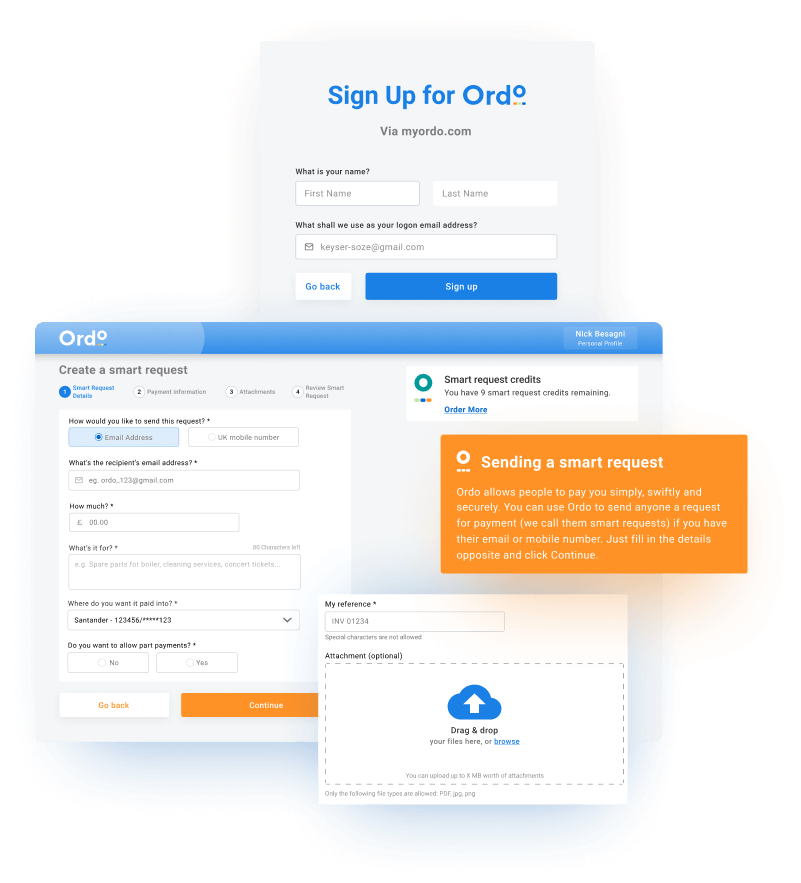

Ordo’s ‘Payments as a Service’ offering, delivers a turn-key solution for Open Banking payments. Ordo’s highly secure service, designed and built by payments experts, provides an array of frictionless payments solutions that are easier than ever for your customers to use, and more cost effective than traditional payment methods.

Play Video

Play Video

Low Fixed Cost. Ordo payments, refunds and pay-outs cost significantly less than equivalent card transactions.

Automatic end to end payment referencing and account details eliminate reconciliation costs and lost payments.

Flexible and effortless payment options available via secure tokenised links, ‘Pay now’ buttons and QR codes; gives the customer control and minimises basket abandonment, with no payer signup needed.

Simple open API integration within weeks enables swift deployment of turn-key service, including white-labelled screens for both biller and payer journeys.

Bank grade securely hosted platform protects from fraud with Secure Customer Authentication (SCA) seamlessly built in. GDPR compliant payment message and attachment delivery and storage.

Boost cash flow with real-time 24 x 7 money transfer via the Faster Payments network. No more waiting multiple working days for payments to clear.

Remove chargeback risk with immediate irrevocable receipt of funds.

PCI DSS compliance abolished as no card or banking details collected, minimising privacy, security and regulatory overhead.

Our highly secure, cloud based, open banking enabled payments platform provides businesses large and small with low cost, secure and easy to use e-commerce, Point of Sale and invoice payments direct from their customer’s bank accounts into their own bank accounts.

We manage not only the specialised open banking and instant payments flows, but the business process requirements of businesses and every step of the interaction with their end customers, providing tailored payment journeys for each business client.

Businesses can access the Ordo platform in a number of ways: though an Ordo Merchant Acquirer/PSP payments partner, via Ordo’s modern APIs, and for smaller businesses, through our integrations with QuickBooks, Sage, and Xero accounting software or directly via Ordo’s web/app interfaces.

Ordo uses Open Banking payments to deliver refunds and secure customer pay outs as well as enhanced account validation services.

See our full set of solutions here

We collaborate with organisations of all sizes and individuals to facilitate fundraising, emphasising a quick, secure, fairer, and enjoyable giving experience – as it should be.

In partnership with CGI, Ordo Team has created a donation page to facilitate fundraising on the spot, particularly in the streets of London during Morph’s Epic Art Adventure. The donations are directed to Whizzkidz to support children and young individuals with wheelchair needs.

In response to the devastating events at Newgale Campsite, we’ve initiated a fundraising campaign through Ordo to aid Dan, Emma, and their family in their time of need. Your support will provide essential assistance and relief to those affected by this tragic event.

Your donation can save lives. Join us in supporting Cancer Prostate UK as we strive to make a difference in the lives of those affected by prostate cancer. Together, we can provide essential resources, research, and support to combat this disease and save lives.

Contact us today to set up a donation page for you.